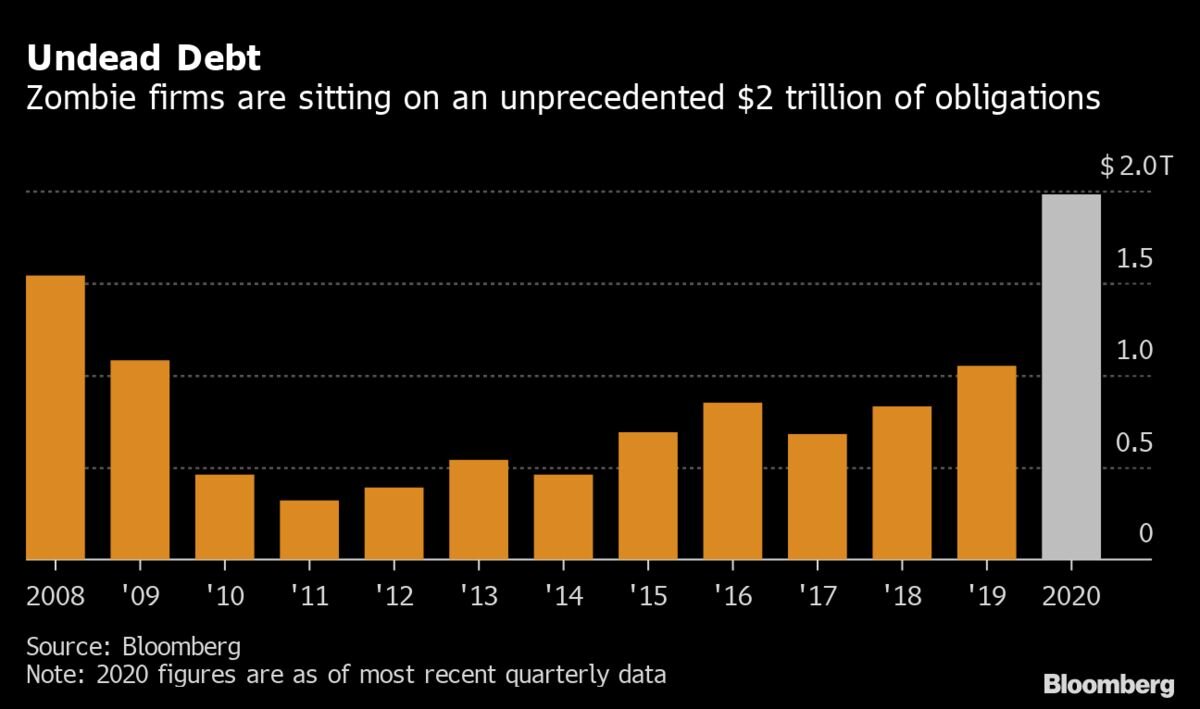

America’s Zombie Companies Rack Up $2 Trillion of Debt

Balance Sheet Growth And The Predictability of Stock Returns

Baretz & Brunelle New Law-AM Law 100’s Move into Alternative Legal Services

Beyond Evergrande, China’s Property Market Faces a $5 Trillion Reckoning

Beware of Zombie Businesses in Your Portfolio

Beware the known unknowns when finance meets AI

BlackRock spreads iShares custody work across Wall Street

Cash Burn: Stocks That Could Go To $0 As Fed Raises Rates

Central bankers are ‘running down the clock’

CENTRAL BANKS: Some market players are starting to fear a major policy error from a central bank

CohnResnick Hedge Fund Illustrative Financial Statements

CohnResnick Private Equity Illustrative Financial Statements

Congressional Research Service: Zombie Corporation Background and Policy Issues

Coronavirus protections could be delaying a bankruptcy crisis

Corporate Debt Maturity and Monetary Policy

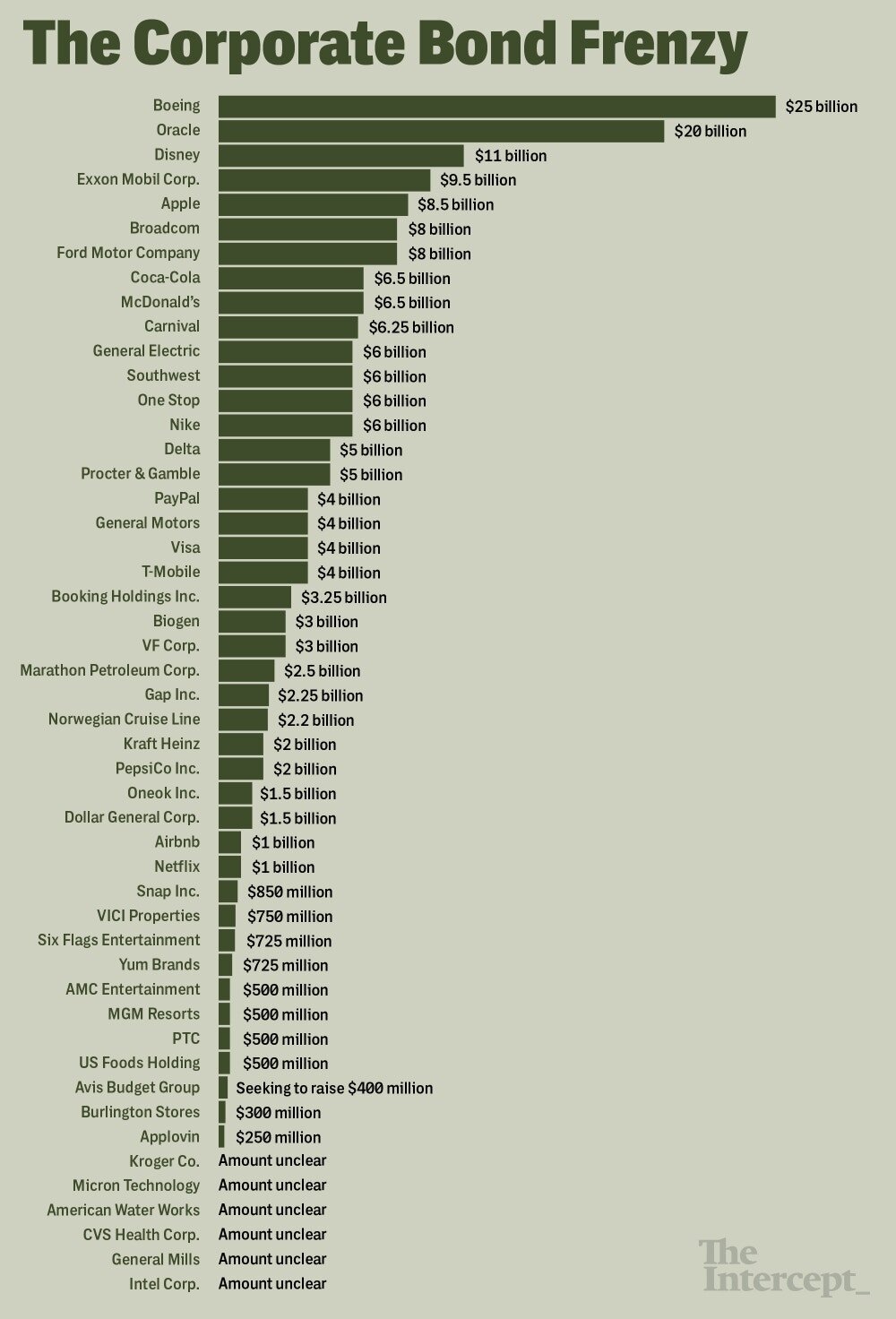

Covid-19 and Corporate Debt Debt Market Stress

Crash Will Last 3 MORE Years": Chamath Palihapitiya

Daunting Debt Dynamics- Goldman Sachs

Default Rate Forecast 2023/24: US Speculative Grade Borrowers and US Leveraged Loans

2024 Default Risk Outlook US Industries

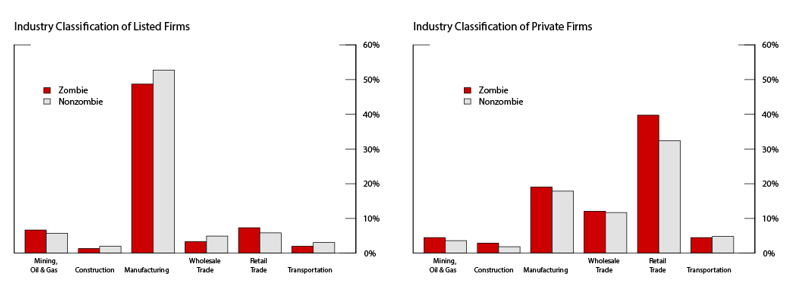

Distressed Firms, Zombie Firms and Zombie Lending : A Taxonomy 2022

Do Investors Overvalue Firms With Bloated Balance Sheets

Evergrande, Kaisa cut by Fitch to default after missed payment deadlines

Evergrande Declared in Default as Huge Restructuring Looms

FASB Eases Transition Away from Libor

FASB Provides Accounting Relief For the Transition Away From LIBOR and certain other reference rates

Fed may finally put America's zombie firms to rest

Fred Economic Data Federal Reserve Bank of St Louis

FinCEN Seeks Comments on Modernization of U.S. AML/CFT Regulatory Regime

Fixing China’s Broken Balance Sheets

Government-Bond Swings Burn Wall Street Investors

Highly Indebted Zombie Companies Control More Than 2 Million Jobs

Highly Leveraged Zombie Companies Threaten the Global Economy

Hutchins Roundup: quantitative tightening, zombie credit, and more

How to Analyze a Balance Sheet

IMF Working Paper Resolving China’s Zombies

Jumbo deals contribute to a rise in M&A and LBO financing

Junk-rated companies enjoy record-low US borrowing costs

Key Findings Fortune 500 Legal Operations

Looking For Trouble And Finding It: The ABA Resolution To Condemn Non-Lawyer Ownership

McKinsey: The Real Story behind US companies offshore cash reserves

Money and Credit Fed’s Balance Sheet

Opinion: Beware of ‘Zombie’ Companies Running Rampant in the Stock Market

Powell says Fed will discuss speeding up bond-buying taper at December meeting

Private capital groups soar on boom in unlisted assets

Prioritizing Wall Street Fed’s Corporate Bond Purchase During the Coronavirus Pandemic

Private Equity Firms Are Cutting Out Banks and Funding LBOs Themselves

Proposed Rule: Money Market Fund Reforms

Market Value : How much an asset or company is worth in a financial market

Most People Have No Idea What's Going On" | Jim Rickards *Economic Collapse 2022

Non Bankruptcy Alternatives to Restructuring and Asset Sales

Recovering and Building Value Business Turnaround

Reinventing The Law Firm Business Model

Rethinking The Law Firm Organizational Form and Capitalization Structure

SEC Had 'Interesting' Meetings With Crypto Firms, Gensler Says

SEC Proposes New Amendments to Money Market Fund Rules

Statement Regarding Treasury Securities and Agency Mortgage-Backed Securities Operations

Stephanie Pomboy on the Corporate Credit Crunch

Strong Buyout Fund Returns Drive Private Equity Stocks Higher

The Accounting Oligopoly: What’s next for the Big Four? | CNBC Explains

The Double-Edged Sword of Seeking Safety in Dollars

The Rise of Zombie Firms: Causes and Consequences

The True Costs of Zombie Companies and Easy Money

The Economy’s Zombie Reckoning

Understanding The Rise of Corporate Cash Precautionary Savings on Foreign Taxes

Using The Income Statement in Legal Practice

US Credit Markets Covid-19 Economic Shock

U.S. SEC to tighten insider trading rules, boost money market fund resilience

US Treasury Lender of Last Resort

U.S. Zombie Firms: How Many and How Consequential?

Understanding market capitalization

Will A Zombie Apocalypse Crush TLT And SPY?

Will Zombie Companies Eat The US Economy

What the Rise of China’s Digital Currency Could Mean for the U.S.

Why has the $600 billion Main Street Lending Program been such a flop?

Zombie Horde of 13 Major Stocks Threaten Unsuspecting Investors

Zombie At Large Corporate Debt Overhang and the Macro Economy

Zombie Credit and (Dis)Inflation Evidence From Europe

Zombie Companies’ Growth and Expansion: Should This Be a Surprise?

Zombie Firms Face Slow Death in US as Era of Easy Credit Ends

Zombie Lending: Theoretical, International and Historical Perspectives